To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Fri-yay Crunch!

We are pretty excited about Disrupt 2023 getting a whole stage dedicated to fintech. And while we’re talking about events…There’s just a few hours left to save $200 on TC Early Stage tickets in Boston in a couple of weeks, so get yer tickets while you can!

On that note, enjoy your weekend! — Christine and Haje

The TechCrunch Top 3

- Italy gives ChatGPT the boot: Italy’s government has been on a blocking kick lately. A few days ago, we wrote about a possible ban on cultivated meat, and today Italy wants to block ChatGPT, citing data protection concerns. Natasha L writes that the country’s data protection authority is opening an investigation into whether OpenAI is breaching the European Union’s General Data Protection Regulation.

- Groupon gets its Czech book: Ingrid reports that Groupon has lost 99.4% of its value since its IPO and now has a new CEO who will run the business from the Czech Republic.

- Jio gets its game on: Manish writes that Mukesh Ambani, CEO of India’s streaming giant Jio, sees the Indian Premier League cricket tournament as “the perfect opportunity to revamp Jio’s service adoption strategy even as the firm recognizes that cricket streaming will not turn a profit for several years.”

Startups and VC

What do you do when you have a very successful and popular product (marijuana) that is legal in some places, but federally has been a Schedule 1 drug since 1970? Well, you can’t rely on any national institutions as your business partners, Haje reports. One of the major places that shows up is in payments and payment processing; even after recreational cannabis became legal in 21 states and decriminalized in another dozen or so, cannabis has become largely a cash business. In a world that is increasingly cashless, that’s a problem for both consumers and businesses. Smoakland is currently beta-testing a loophole that lets its customers pay by credit card. The secret, it turns out, is crypto.

Need some more to get you through the long bleak gap of “less tech news” known as the weekend? Don’tcha worry fam, we gotchu:

- Down in proverbial flames: Aria reports that Virgin Orbit burns up in uncontrolled descent.

- Teaching an old browser new tricks: Artie sidesteps the app stores by putting high-quality games in your browser, Haje reports.

- Pouring our hearts out: Haje reviewed a fancy-ass $700 coffee maker and concludes that xBloom makes perfect pour-over so you don’t have to, before asking if you would want to.

- Not worthless, but worth less: U.S. investors slash Byju’s and Swiggy valuation, reports Manish.

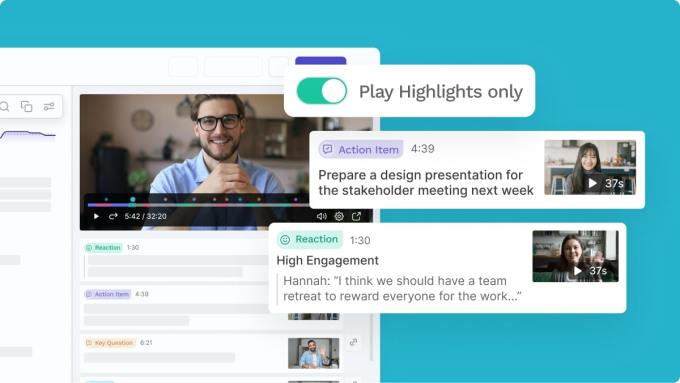

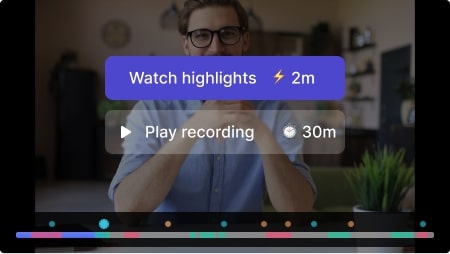

- This meeting could have been a summary: Ivan reports that Read’s AI-powered summary feature squeezes a meeting into a two-minute clip.

Yeah, of course, YC’s winter class is oozing with AI companies

Image Credits: Getty Images

Just over one-third of the fledgling startups in Y Combinator’s latest class say “that they are an AI company or use AI in some kind of way,” reports Rebecca Szkutak.

“You can’t blame the YC companies for leaning into AI,” she writes. “If you saw VCs dumping dollars — in a tougher fundraising market, no less — into a technology like AI that you could implement into your own business, why wouldn’t you?”

Three more from the TC+ team:

- Okay, here’s the game plan: Anna and Alex have the lowdown on European startups looking to raise money in 2023.

- Damn the torpedoes, full steam ahead: Investors are unfazed by Q1 crypto funding decline, writes Jacquelyn.

- You’re hired! Anastasiia Kuzmenko shares three recruiting metrics that can help startups make more data-driven hiring decisions.

TechCrunch+ is our membership program that helps founders and startup teams get ahead of the pack. You can sign up here. Use code “DC” for a 15% discount on an annual subscription!

Big Tech Inc.

Checkout.com has a new president who recently spoke with Mary Ann about being bullish on a U.S. expansion and how she “welcomes” comparisons to Stripe. Céline Dufétel says of the payments industry this year: “Now more than ever amid the uncertain economic landscape, CFOs and heads of payments are narrowing in on the impact of payments on topline growth and profitability. Increasingly, business leaders are recognizing the measurable impact of high-performing payments systems in maximizing acceptance rates, minimizing costly fraud concerns, and reducing operational costs.”

And we have five more for you:

- What’s going on with the TikTok ban?: We’re so glad you asked. Taylor gives you the play-by-play.

- TV turned on its side: No, you aren’t seeing your Hulu interface wrong. The streaming company changed some things around, including a revamped sidebar on the left, Ivan and Lauren write.

- You can’t do that on social media: The lower chamber of the French parliament passed an influencer bill cracking down on risky products. Romain has more.

- Going public: Helbiz stock tumbles on reverse split, but it’s okay because they are rebranding to Micromobility.com, Rebecca writes.

- Quite taxing: Amanda played an anime dating sim that does your taxes for you and has some notes.

Daily Crunch: Citing data privacy concerns, Italy temporarily bans ChatGPT by Christine Hall originally published on TechCrunch