To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PST, subscribe here.

TikTok just can’t dodge the watchful eyes of the watchmen: Earlier this year, Taylor reported that a string of universities banned TikTok from devices. Last week, Paul reported that the European Commission threw the kibosh on having TikTok on work devices, and today, Amanda reported that Canada followed suit for its government devices. The bans are coming down over concerns that China-based TikTok can be used to spy on its users.

The TechCrunch Top 3

- Raise the roof: Continuing to work remotely in 2023 remains a hotly contested issue in today’s workplaces. What if we told you that Gable can give your company better remote working options? Still with us? Okay, Haje writes about how Gable raised $12 million to not only show your remote employees a nearby workplace, but also show them if any of their colleagues are there so they can connect.

- The world in the palm of your hand: Reporting from Mobile World Congress, Brian sat down with OnePlus’ COO Kinder Liu to discuss the company’s first foldable phone.

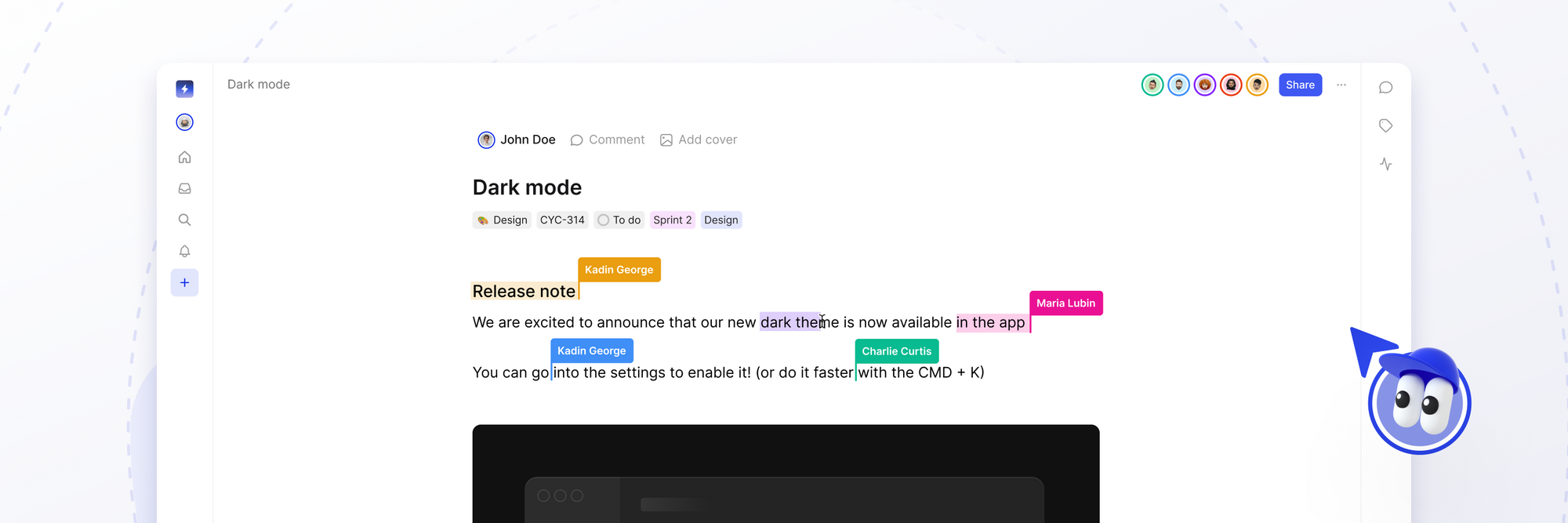

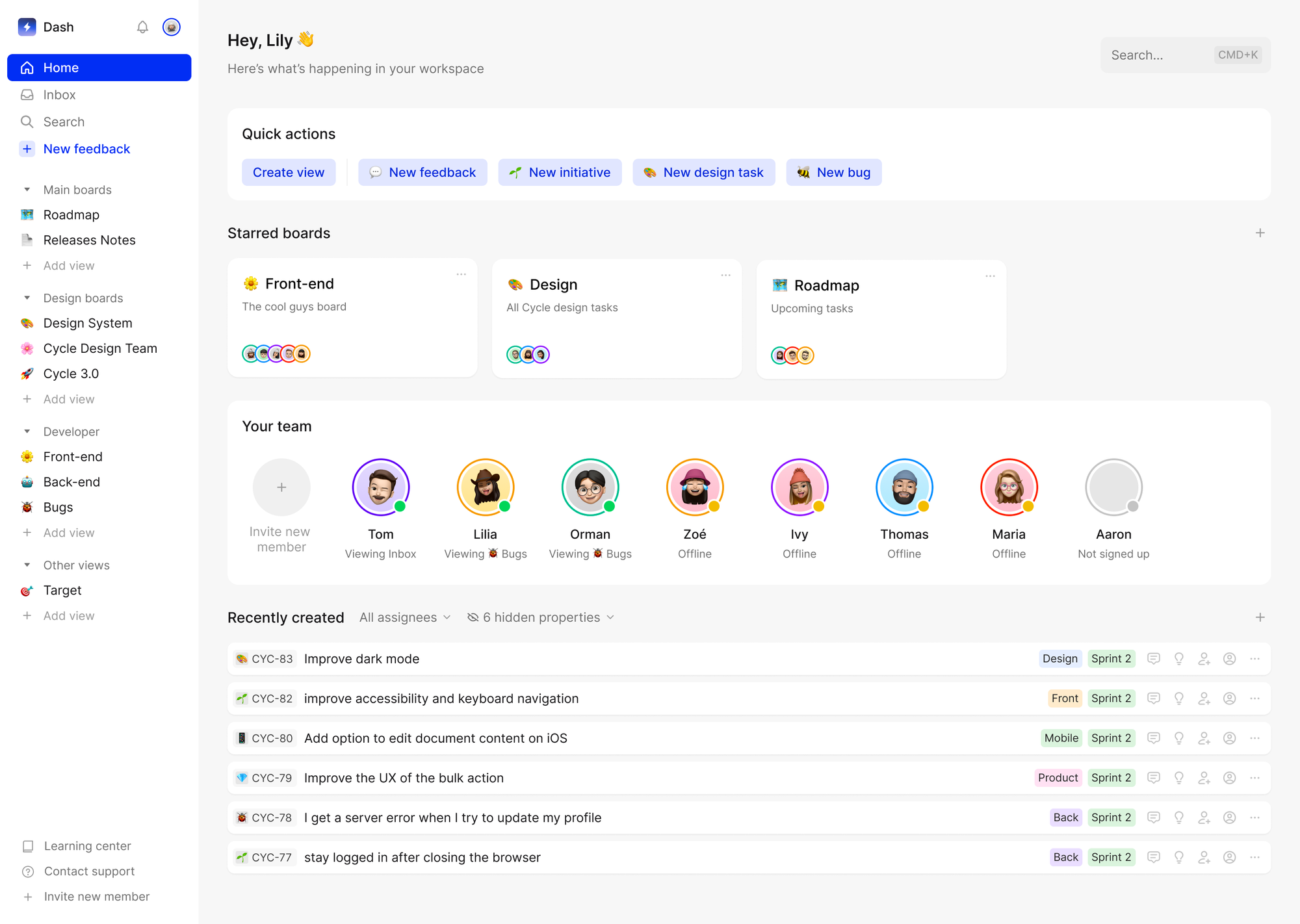

- Closing the feedback loop: Engaged customers are where your company can get some of its best ideas for new products. Cycle snagged $6 million to help companies collect all of that customer feedback for a more streamlined product management process, Romain writes.

Startups and VC

Bain Capital Ventures is doubling down on what works, literally, Natasha M reports. The venture firm, one of Bain’s 11 financial divisions, has raised $1.9 billion across two funds, one for seed for growth-stage startups that hovers around $1.4 billion, and one for later-stage opportunities that closed around a third of that, at $493 million.

Devin reports that the FTC, fresh off announcing a whole new division taking on “snake oil” in tech, has sent another shot across the bows of the overeager industry with a sassy warning to “keep your AI claims in check.”

And we have five more for you:

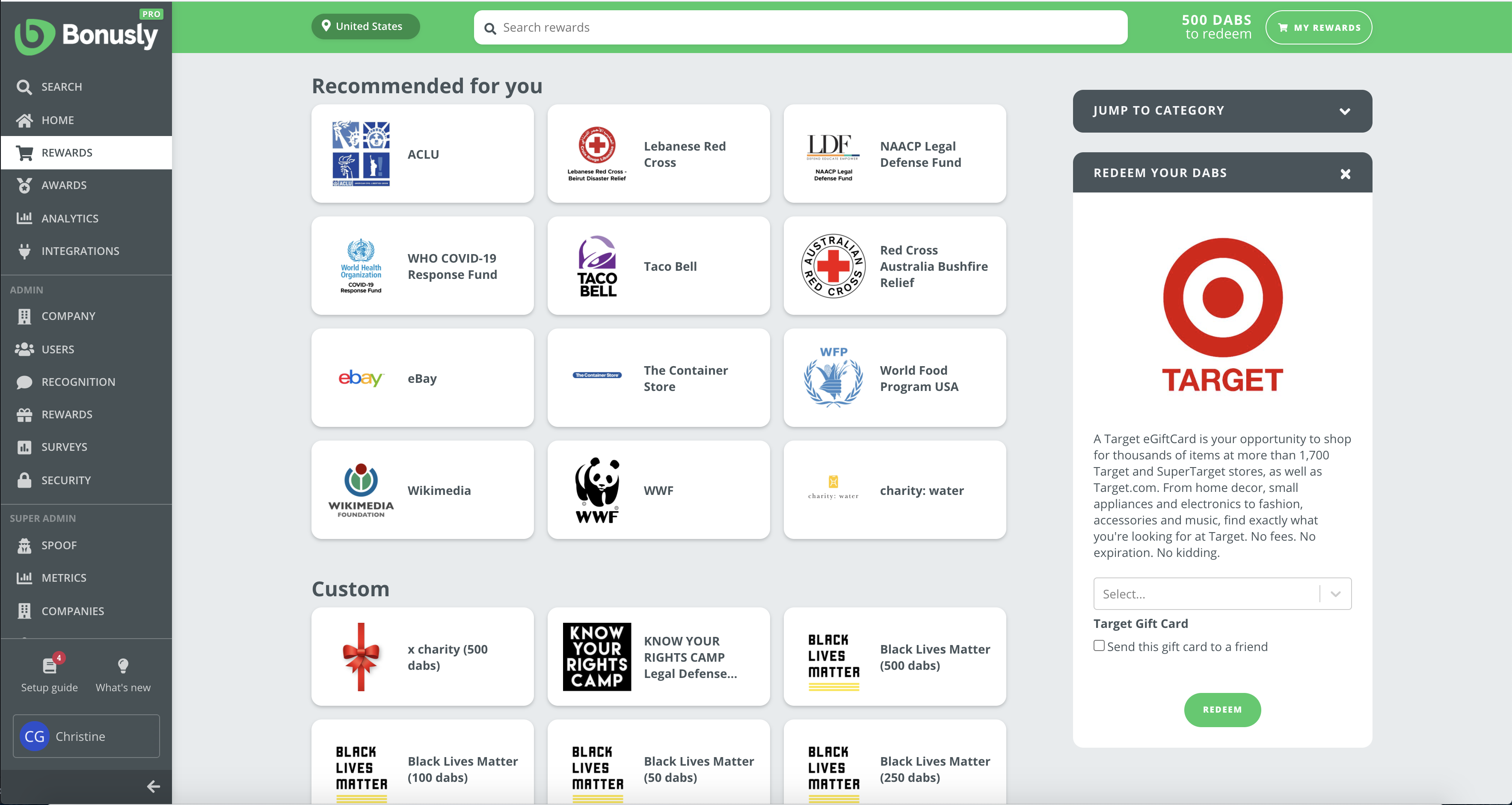

- A job well done, Kyle: Bonusly is a startup aiming to help employees get recognized for quality work, and it just told TechCrunch it raised $18.9 million, writes Kyle. He deserves a bonus for an article well written.

- DTCtR: Christine asks, Want to go from direct-to-consumer to retail? This startup has a platform for that.

- Yeah, you can do that: Entitle raises $15 million seed round to modernize permissions management, Frederic reports.

- Who markets the marketeers: Emily Kramer and Kathleen Estreich started a VC firm to scale what “founders are starving for,” Natasha M reports.

- A high-flying startup: Astroscale closes new funding to grow in-orbit servicing and orbital debris cleanup tech, Aria reports.

Active learning is the future of generative AI: Here’s how to leverage it

Image Credits: Andriy Onufriyenko (opens in a new window) / Getty Images

The generative AI models that have made headlines and memes in recent months weren’t cooked up in someone’s garage or basement.

“Only well-funded institutions with access to a massive amount of GPU power are capable of building these models,” says Encord co-founder Eric Landau, who recommends using the iterative process of active learning to “leapfrog the AI production gap and build models capable of running in the wild more quickly.”

In a TC+ post aimed at ML team managers, he shares tactics for leveraging active learning and addresses the perennial buy-versus-build dilemma.

Three more from the TC+ team:

- A show of force: With 5 activists in the mix, Salesforce will report earnings Wednesday, reports Ron.

- Buy now, profit later: How much progress is Klarna making toward profitability? wonders Alex.

- A legal influence: Nicholas Saady explores key legal issues for influencers and brands (and how to deal with them).

TechCrunch+ is our membership program that helps founders and startup teams get ahead of the pack. You can sign up here. Use code “DC” for a 15% discount on an annual subscription!

Big Tech Inc.

As you can see from our stories today, Brian has been writing a lot about new phones lately. In this particular article, he spoke with Nothing’s Carl Pei about the company’s expansion strategy and its upcoming Phone (2) and how it will run on Qualcomm’s Snapdragon 8 series.

Meanwhile, Microsoft is really going all in on this artificial intelligence thing for Bing. Frederic reports that the software giant brings the new Bing to Windows 11 while also launching Phone Link for iOS.

And we have five more for you:

- Give me fiverr: Fiverr now has a white-glove offering to help businesses hire project managers, Kyle writes.

- Give me your best interconnected web: Flipboard now has a Mastodon integration among other Fediverse offerings, Sarah reports.

- Give me a game fix: Lorenzo entered the world of gamers trying to fix a video game “taken over” by hackers, and what results is a delightful read.

- Give me a spot south of the border: Mexico’s president confirms that Tesla’s next factory will be in that country. Kirsten has more.

- Give me a hot minute: Mike writes that 6G is coming, just not yet.

Daily Crunch: Remote workspace platform Gable raises $12M Series A by Christine Hall originally published on TechCrunch