To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Oh hey and happy Tuesday, the very last day of May 2022! Tomorrow, for our City Spotlight series, we’re putting the limelight on Columbus, Ohio. We’re also doing a pitch-off with Columbus-area startups. If you want to register for the event, here’s the handy linky-link that will give you all the info you need! — Haje and Christine

The TechCrunch Top 3

- Amazon retires Cloud Cam to the big electronic home in the sky: It was a Big Tech kind of day today, and first up is Amazon, which informed Cloud Cam users that it will no longer support the device. You might remember that Cloud Cam was one of Amazon’s first home security devices in 2017 — that is until it acquired both Ring and Blink within a year later. Amazon is winding down the service this year, and “Cloud Cammers” will get a complimentary Blink mini and a one-year subscription for their troubles.

- Apple’s iOS 16 leak: Our other Big Tech story involves some Apple news ahead of its WWDC event on June 6. Not sure how much people think about their iPhone’s lockscreen, but Apple does, and a report says the tech giant is about to unleash a significant upgrade that may involve widgets. And Sarah hopes Apple also does something about Focus Mode.

- Crypto may have a remittance payment problem: Could there be a disconnect between Andreessen Horowitz’s views about cryptocurrency’s current usefulness and the low-tech way people still get paid in emerging countries? Anna lays out her argument for why a16z’s crypto bullishness may be a bit premature in these regions.

Startups and VC

Two new funds got announced this morning; Haje covered Hannah Grey’s $52 million debut fund, focusing on customer-centric founders, and Christine took a look at Bonfire Ventures, which raised a pair of funds, totaling $230 million, targeting B2B software startups.

Apart from a couple of new funds, it’s been a lively few days on the site over the long weekend, so let’s make like a truffle-hunting pig and dig our snouts in:

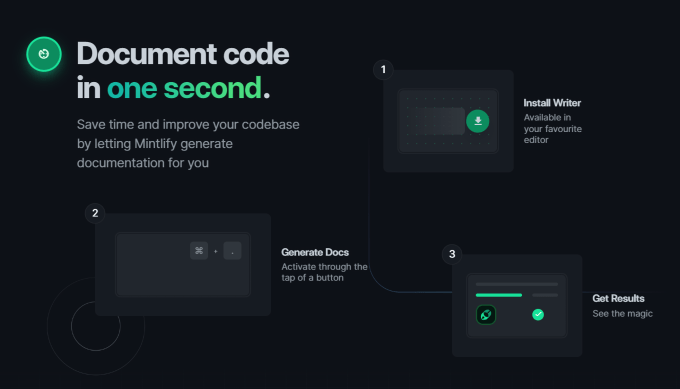

- Hello, world (it says Hello World): I’m pretty intrigued by the startup Kyle covered this morning; Mintlify uses AI to auto-generate documentation based on source code, raising $2.8 million to do so.

- Go, go, go: Also from Kyle, Railway raised $20 million to make software deployment for apps and services smoother.

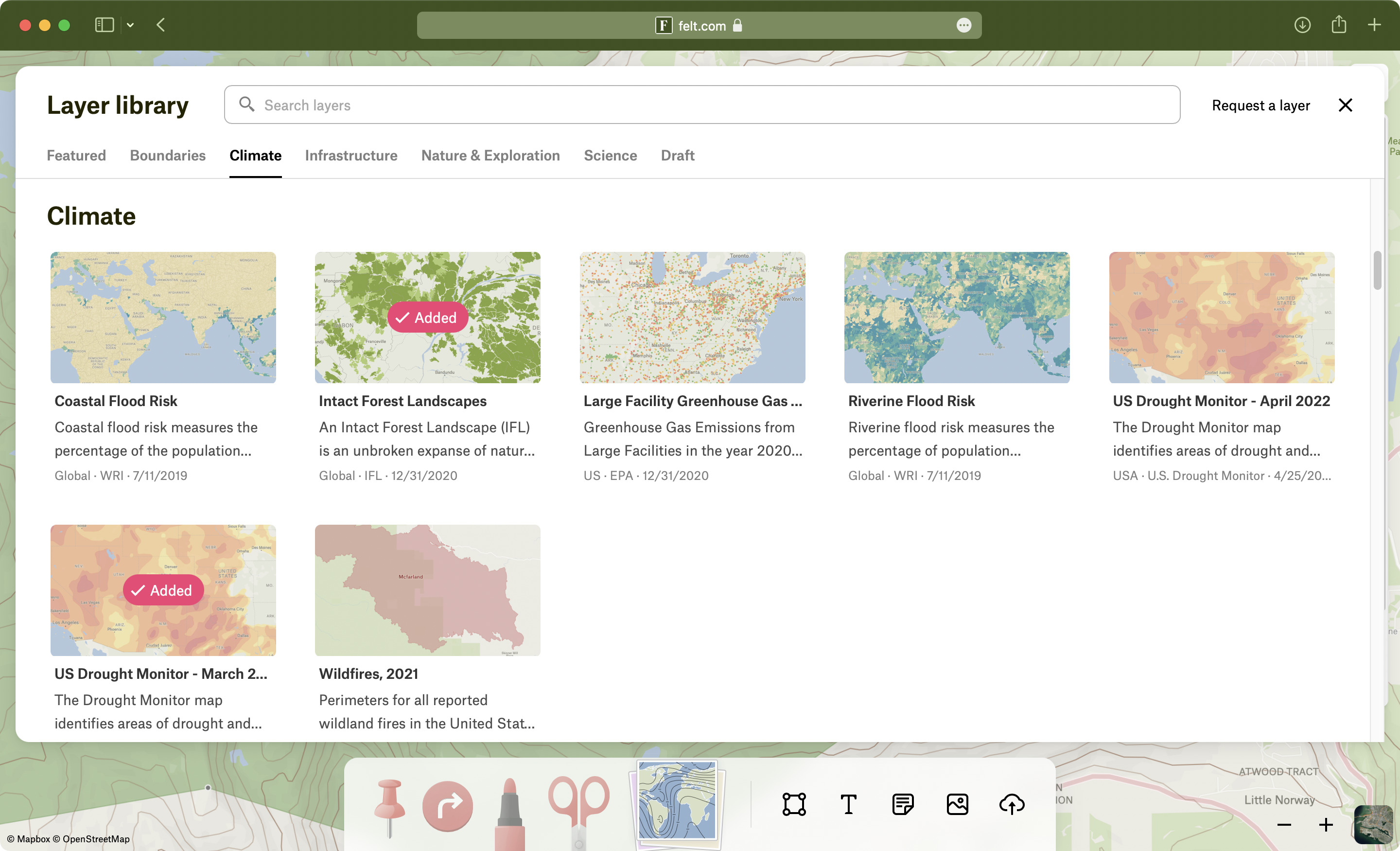

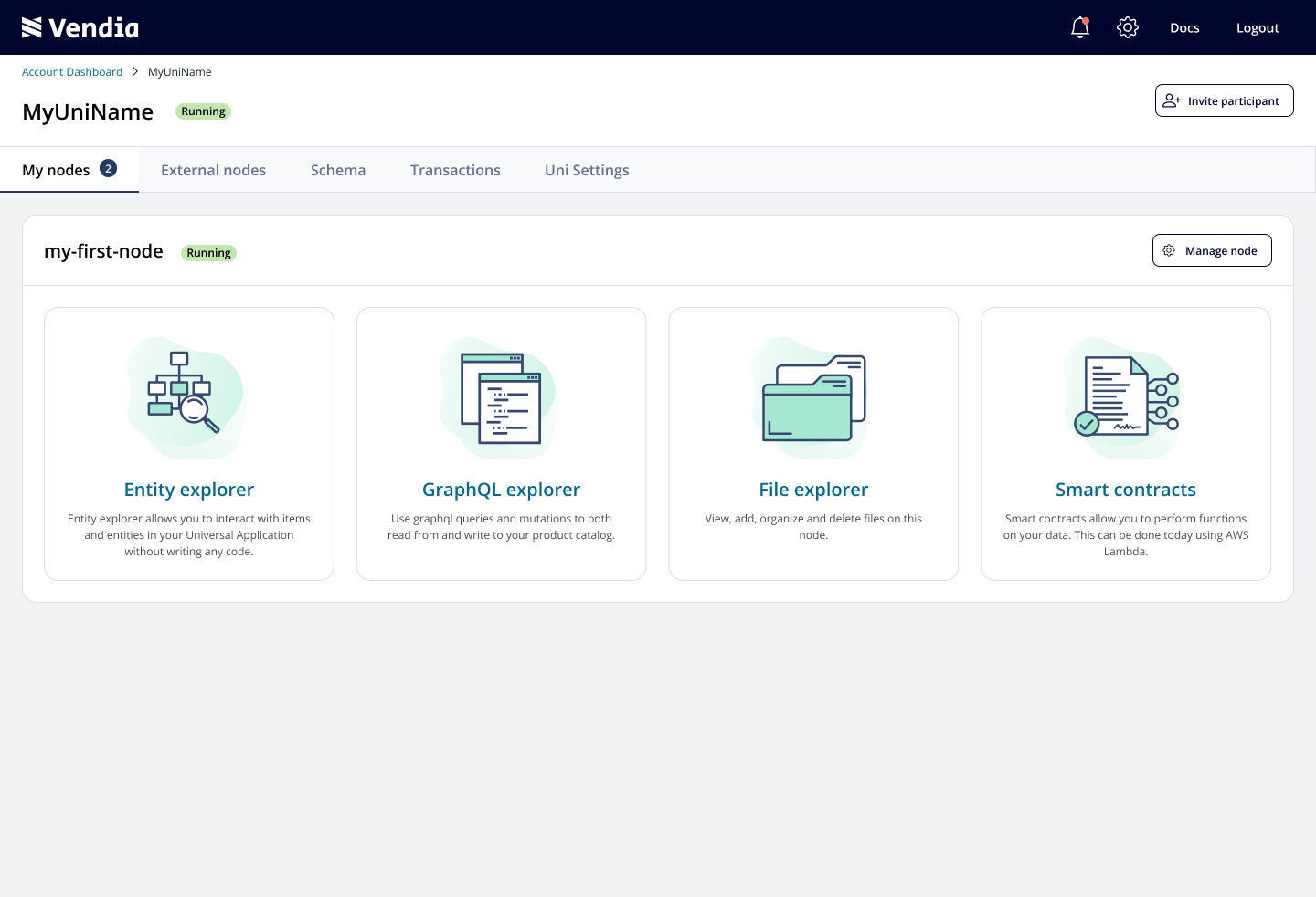

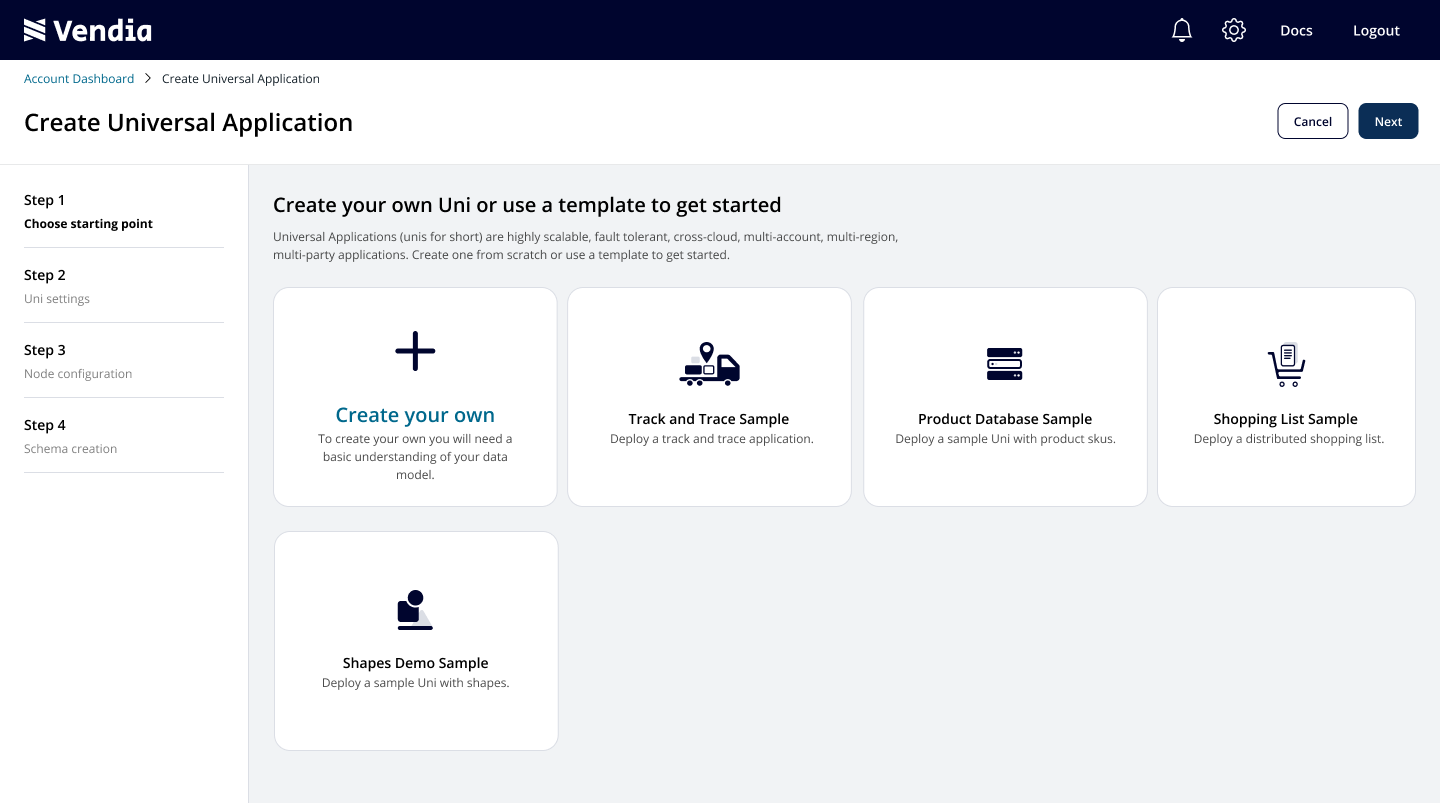

- (data) sharing is (data) caring: Vendia, a blockchain-based platform that makes it easier for businesses to share their code and data, today announced that it has raised a $30 million Series B, Frederic reports.

- Didn’t see that one coming: Seemplicity is emerging from stealth with $32 million in funding for a platform that it believes will help security teams assess and respond to security threats, Ingrid reports.

- They totally bought it: Onramp Funds, an Austin-based company providing financing to e-commerce sellers, secured $42 million in equity and credit to expand its working capital offering, Christine reports.

- So fast it’ll make your head swvl: Swvl went public a couple of months ago, and today announced it’s laying off almost a third of its workforce, Tage writes.

- You need your can of Coke how fast?!: Seems like Indonesia is enjoying life in the fast lane, with Rita reporting that 15-minute grocery delivery startup Astro just closed a $60 million round.

8 IT spending trends for the post-pandemic enterprise in 2022

Market research firm ETR contacted 1,200 IT leaders who oversee a yearly collective IT budget of approximately $570 billion to learn more about their planned spending over the coming year.

Although year-over-year spending is projected to rise just 6.7%, “the need for experienced IT personnel has accelerated, and hiring demand in the space has reached the highest level we have ever seen,” writes Erik Bradley, ETR’s chief analyst.

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

- Payment installments are ‘in’: If you didn’t already know, and thanks to a new partnership between Affirm and Stripe, consumers will see more “buy now, pay later” options when they check out. Though no specific number was written, Mary Ann reports the new offering applies to “businesses that use Stripe’s payments tech” — meaning, millions. And, with the BNPL space as competitive as it is, that certainly gives Affirm a new revenue stream to work with.

- Netflix’s password woes or ‘whoas,’ both apply: There seems to be some confusion in Peru around Netflix’s new policy on account sharing. For Netflix, that meant anyone using someone’s account in the same building. However, a recent survey brought to light two things: one, some subscribers in Peru weren’t notified of the extra charges before being charged them, and two, Netflix’s own customer service agents reported not quite understanding the new policy and helped subscribers get around it. Netflix hopes to roll out the policy this year, but maybe it needs to clarify some things first.

- TikTok secretly created a new feature; let’s see what happens: For those of you who dislike all of the words on top of your TikTok videos, relief is coming in the way of a new feature being tested called “clear mode.” When engaged, it eliminates those pesky usernames, captions and audio information, and in some cases the like, comments and share buttons, too, for what Aisha noted would be “a completely distraction-free viewing experience.”

Text GO to 1-844-228-4544

Text GO to 1-844-228-4544